Self-storage cap rates hit their lowest point at 5.0% in Q4 2022. The investment landscape has changed in the last six quarters as investors saw average capitalization rates of 5.8%.

The self-storage industry’s transaction volume reached $2.85 billion in the first half of 2025. Market values have dropped steadily since then. The industry’s peak value was $174.00 per square foot in Q1 2023. Values fell for six straight quarters and reached $159.00 per square foot by Q2 2025. The market shows promise now that operators report positive new-customer rate growth for the first time since 2022.

This piece will help you learn about today’s self-storage cap rates and get into what drives market performance. You’ll get useful tips to navigate this changing sector. These insights will help you make smart choices about new purchases or improve your current properties in today’s market.

Understanding Cap Rates in the Self-Storage Industry

Cap rate is the lifeblood metric when evaluating self-storage investments. This basic calculation turns a property’s income into a percentage and helps investors quickly assess potential returns.

What is a cap rate, and why does it matter

Cap rate shows the unleveraged annual return on a property investment as a percentage. Investors use this metric as a standardized way to compare different self-storage facilities, whatever their price point or size. It helps determine appropriate pricing in a market and reflects how the market sees the investment risk. The property value goes up when cap rates go down, and the value drops when cap rates rise.

How cap rates are calculated in self storage

The cap rate calculation is simple: Net Operating Income (NOI) divided by the current market value or purchase price. A storage facility that generates $120,000 in NOI and sells for $2 million would have a 6% cap rate.

The property’s value using the cap rate comes from dividing the NOI by the desired cap rate:

Value = NOI ÷ Cap Rate

A facility with $100,000 in NOI at a 5% cap rate would be worth $2 million. This helps investors figure out the right offer prices based on market conditions and expected returns.

Historical trends in self-storage cap rates

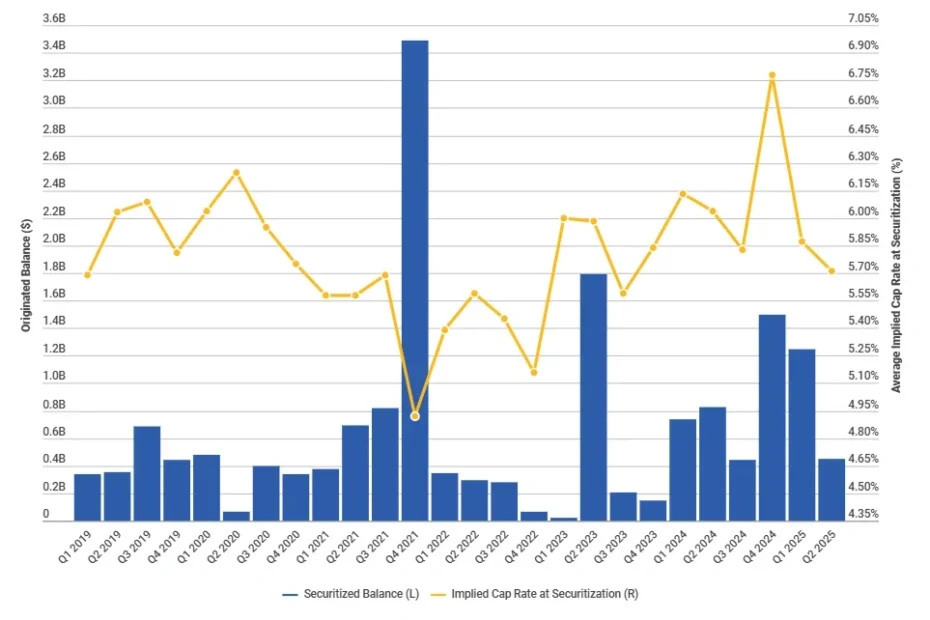

Self-storage cap rates reached their lowest point in Q4 2022 at 5.0%. Interest rates pushed them up by about 90 basis points to 5.9% by Q2 2024.

Class-A assets now typically range from 5% to 5.5%, while class-B properties sit between 5.5% to 6.5%. More recent analysis shows rates climbing still higher, with Q4 2024 averages hitting 6.20%, up from 5.86% in Q3.

The industry outlook stays stable. A recent survey of over 50 self-storage experts found 56% expect little to no change in cap rates over the next 12 months. All the same, the link between cap rates and interest rates remains a key concern for investors in the self-storage market.

Key Market Forces Shaping Cap Rates in 2024

Economic factors are shaping self-storage cap rates in 2024. Property investors face a complex environment as they try to make informed decisions.

Impact of interest rates and inflation

The Federal Reserve’s aggressive rate hikes to curb inflation have directly affected self-storage valuations. Cap rates rose by 90 basis points from their Q4 2022 low to 5.9% in Q2 2024. This upward pressure continues despite inflation showing signs of moderation. Spreads between cap rates and the 10-year treasury stay well below historical levels.

Replacement costs have soared as inflation has altered the acquisition landscape. New facilities now trade at approximately $300 per square foot, a dramatic increase from the $60-$80 range seen a few years ago. Existing operators have benefited from this inflation through higher rental rates. Some report 20-40% increases in street rates.

Supply-demand dynamics in major regions

Market performance varies substantially across the country. Midwest and Southwest markets show the steepest declines in rent per available square foot at -11.2% and -10.1% respectively. Los Angeles stands out with rent increases of 6.1%.

The construction pipeline has shrunk to 2.7% of inventory under construction—down from 3.4% a year ago. Dodge Pipeline reports more projects on hold in Q2 2024. This suggests construction might stay at moderate levels.

Investor sentiment and risk tolerance

Self-storage experts believe cap rates will see little to no change over the next 12 months, with 56% supporting this view. The housing market slowdown ranks as the top investor concern at 39%, while interest rates follow at 35%. Investor interest remains strong with 65% of respondents planning to be net buyers.

Role of self-storage market data in pricing

Discounted cash flow analysis has become crucial for investors determining market valuations. They pay close attention to terminal or exit cap rate assumptions. NOI growth plateaus have revealed potential pressure points through debt yield stratification across upcoming maturities. The 2028 cohort might face challenges under stricter lending standards due to thinner equity cushions.

Forecasting Self Storage Cap Rates for 2025 and Beyond

Self-storage cap rates will likely reach a period of stability through 2025-2026.

Expected trends in cap rate compression or expansion

Market volatility in 2024 will give way to more stable self-storage valuations in 2025. Cap rates might stay flat or see slight compression. Stabilized properties now show cap rates from mid-5% to low-6%. Investors have adapted to the new interest rate environment, though cap rates remain lower than expected given the softer market fundamentals and current debt costs.

How construction slowdowns affect future valuations

A dramatic slowdown in construction has created new opportunities on the supply side. Developers will deliver only about 20 million rentable square feet through 373 projects in 2025. This marks a steep decline from 2024’s 59 million square feet across 985 projects. Supply pressures will keep falling after 2025. New deliveries should drop from 3.5% of existing stock in 2024 to roughly 2% by 2027.

Regional outlook: Sunbelt vs Coastal markets

Different regions now show uneven market performance. Limited land availability and tight supply have helped coastal markets take the lead. Washington, D.C., stands out with 15.4% rent growth over three months and 12% year-over-year gains. Other strong performers include Chicago at 14.4%, New York at 11.6%, and Los Angeles, showing 7% annual growth.

What REITs and institutional buyers are signaling

Major institutions now focus on optimization rather than expansion. Extra Space Storage channeled almost all its $950 million investment activity in 2024 toward off-market deals through existing relationships. CubeSmart’s recent $160 million purchase of an 85% stake in a 14-property portfolio shows continued faith in the sector.

Investment Strategies for Navigating Cap Rate Shifts

The challenging self-storage investment landscape demands practical strategies that separate success from failure. Your approach must adapt to evolving market conditions.

How to underwrite deals in a high cap rate environment

Conservative underwriting has become crucial with current self-storage cap rates ranging from 7% to 10%. Your purchase price should be based on current performance (Scenario A) rather than projected improvements (Scenario B). A facility generating $100,000 in NOI at a 7% cap rate should max out your offer at $1.43 million. You need to run multiple scenarios and think about debt costs since the spread between cap rates and interest rates directly affects cash flow.

Identifying value-add opportunities

Value-add investments can tap into significant upside in unstable markets. Adding climate-controlled units can boost NOI by as much as 25%, which could increase valuation by over $535,000. Here are other profitable additions:

- Boat/RV parking ($60,000 annual NOI increase)

- Tenant insurance programs ($30,000 annual NOI increase)

- Truck rentals ($24,000 annual NOI increase)

These improvements can boost NOI and compress cap rates through asset class improvement.

Stress-testing your investment assumptions

We tested our deal’s resilience to various market pressures. You should push down occupancy to find your break-even point. The full picture should include:

- Interest rate increases (run scenarios with rates 50-100 basis points higher)

- Market cap rate expansion

- Extended hold periods beyond your exit timeline

- Property tax reassessment after acquisition

When to buy, hold, or sell in 2025

The second half of 2026 might bring better pricing if borrowing costs start to ease. Rather than trying to time the market perfectly, each opportunity needs independent analysis. Current owners facing loan maturities might find refinancing tough with rates 200-300 basis points higher than a few years ago. Strong fundamentals should encourage holding, as most experts believe values will eventually increase at “appreciable rates of return”.

Conclusion

Self-storage cap rates paint a clear picture of today’s investment landscape. These rates hit historic lows in 2022 but have found stability around 5.8% in recent quarters. The market shows signs of recalibration rather than any fundamental weakness.

Smart investment decisions depend on understanding these trends. The safest approach lies in conservative underwriting, especially with properties trading at cap rates between 7% and 10%. Purchase prices based on current performance, not optimistic projections, help protect against potential downside risks.

Smart investors should pay attention to regional differences. Coastal markets lead the pack, as Washington D.C., Chicago, and New York show impressive rent growth. Construction activity has slowed down dramatically, which could create favorable supply-demand conditions beyond 2025.

The market adjustment period brings great opportunities for value-add strategies. Adding climate-controlled units, boat/RV parking, and extra services can boost NOI by a lot. These improvements might even compress cap rates through asset class upgrades.

Market uncertainty exists, but most industry experts believe cap rates will stay relatively stable through 2025. Successful investors will stand out by stress-testing their investments against interest rate changes, occupancy issues, and longer hold periods.

The self-storage sector shows amazing resilience despite economic challenges. Patient investors who really analyze each opportunity, stick to disciplined underwriting standards, and excel at operations will find great returns as the market stabilizes. Investors with enough capital and operational expertise might find ideal buying opportunities as they guide through these transitional times.